Retirement Planning: Social Security COLA and Portfolio Considerations

|

For retirees and those approaching retirement age, there is no goal more important than ensuring their savings will support a long retirement. This challenge has been compounded by inflation over the past several years, which has eroded the purchasing power of cash savings. Today, prices remain elevated for the key spending areas affecting retirees the most, including healthcare, housing, and everyday necessities. Even though stocks and bonds are well-positioned to meet this challenge, some retirees may be risk averse, while others may wonder if their portfolios and savings will be enough to combat a rise in the cost of living. For long-term investors, understanding how inflation affects retirement income, and how to position portfolios to maintain purchasing power, remains as important as ever. What should retirees and those planning for retirement know about navigating today's environment? Social Security adjustments don't always keep pace with experienced inflation

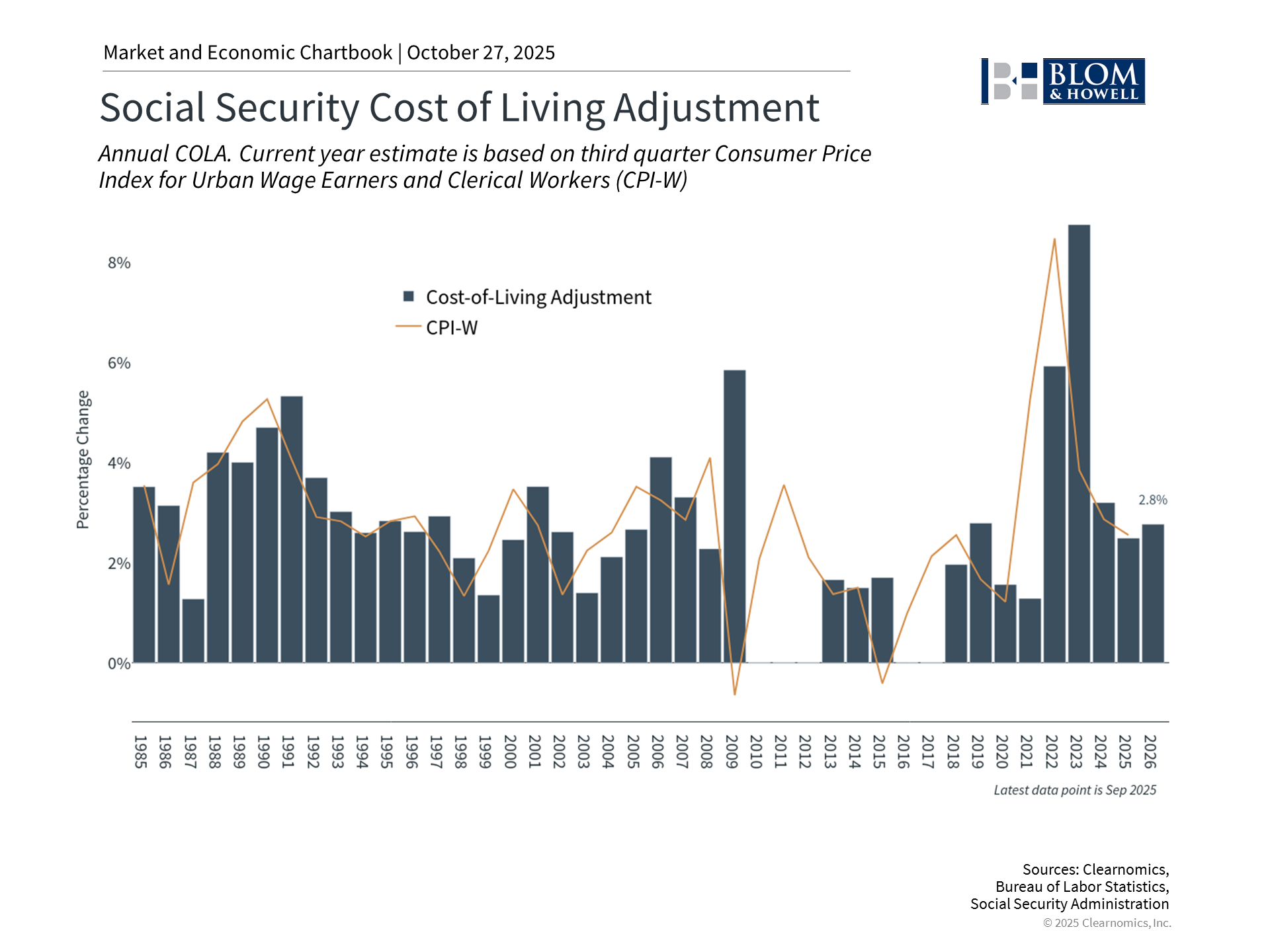

The Social Security Administration recently announced a 2.8% cost-of-living adjustment (COLA) for 2026, reflecting continued inflation. While any increase helps, the reality is that the price increases measured by economists can differ from what we experience on a day-to-day basis. Specifically, this will raise the average monthly benefit to $2,064, an increase of only $56. This is small in comparison to the 8.7% adjustment in 2023, which was the largest since 1981. The challenge for retirees is that while price increases may slow, prices themselves rarely ever come down. The COLA is calculated using a version of the Consumer Price Index known as the CPI-W, which tracks prices for working-class households. However, this doesn't account for the fact that retirees often face different inflation rates than younger workers. Healthcare costs, housing expenses, and other categories that weigh heavily in retiree budgets have often risen faster than the overall index suggests. For example, the category of medical care services rose 3.9% over the past year, health insurance increased 4.2%, and home insurance climbed 7.5%. Food prices increased 3.1% over this period but meat, poultry and fish rose 6.0%. The cost of full service restaurants grew 4.2% more expensive as well. Adding to the challenge, Medicare Part B premiums could rise $21.50 per month in 2026, from $185 to $206.50 according to the latest Medicare trustees' estimates. Since this is typically deducted directly from Social Security checks, this would account for approximately 38% of the average $56 COLA increase, leaving retirees with even less purchasing power. Longer life expectancies increase the importance of portfolio growth

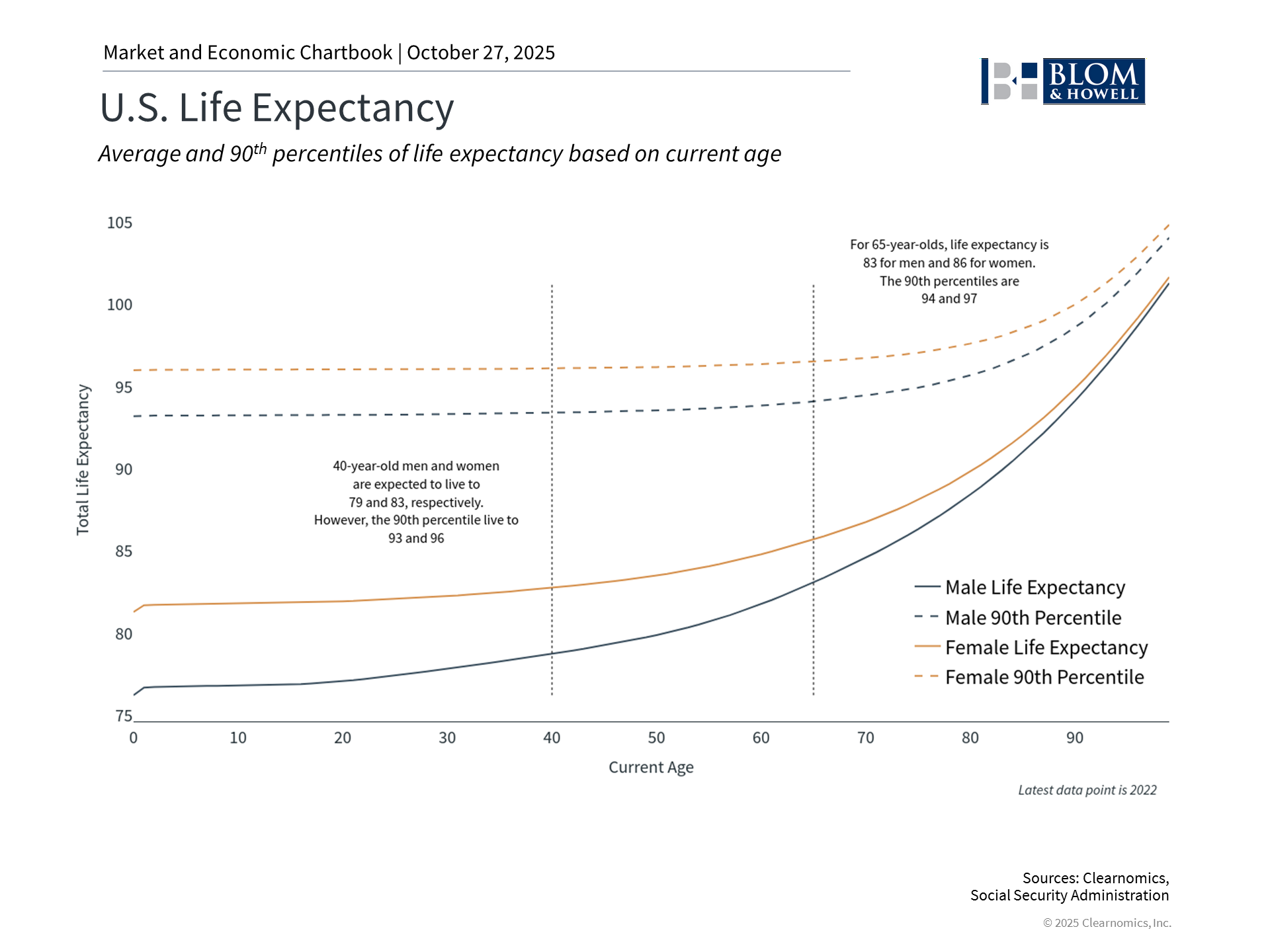

Just as gains can compound over time, so do losses if the purchasing power of a portfolio does not keep up with inflation. This is even more important today since retirees must also plan for the possibility of living longer than previous generations. This means that life expectancy is an important input to any financial plan. According to the latest Social Security Administration data, 40-year-old men and women have an average life expectancy of 79 and 83, respectively. However, for those who make it to 65 years of age, their life expectancies increase to 83 and 86. These are just averages - those in the 90th percentile could live to 94 and 97, respectively. While the opportunity to enjoy a longer, healthier retirement is a wonderful development over the past century, the difference between a 20-year retirement and a 30-year or longer retirement has dramatic implications for portfolio construction and withdrawal strategies. This is sometimes known as “longevity risk,” a challenge that is asymmetric since running out of money during retirement is far more problematic than leaving assets to loved ones or charitable causes. So, while many prioritize income-generating investments like bonds when it comes to retirement planning, it’s also important to maintain growth-oriented assets like stocks. It also creates financial challenges that make thoughtful planning even more valuable. Understanding how to structure portfolios for multi-decade retirement periods, while managing withdrawal rates and adapting to changing market conditions requires expertise that goes well beyond simple rules of thumb. Lower short-term interest rates also reduce income from cash

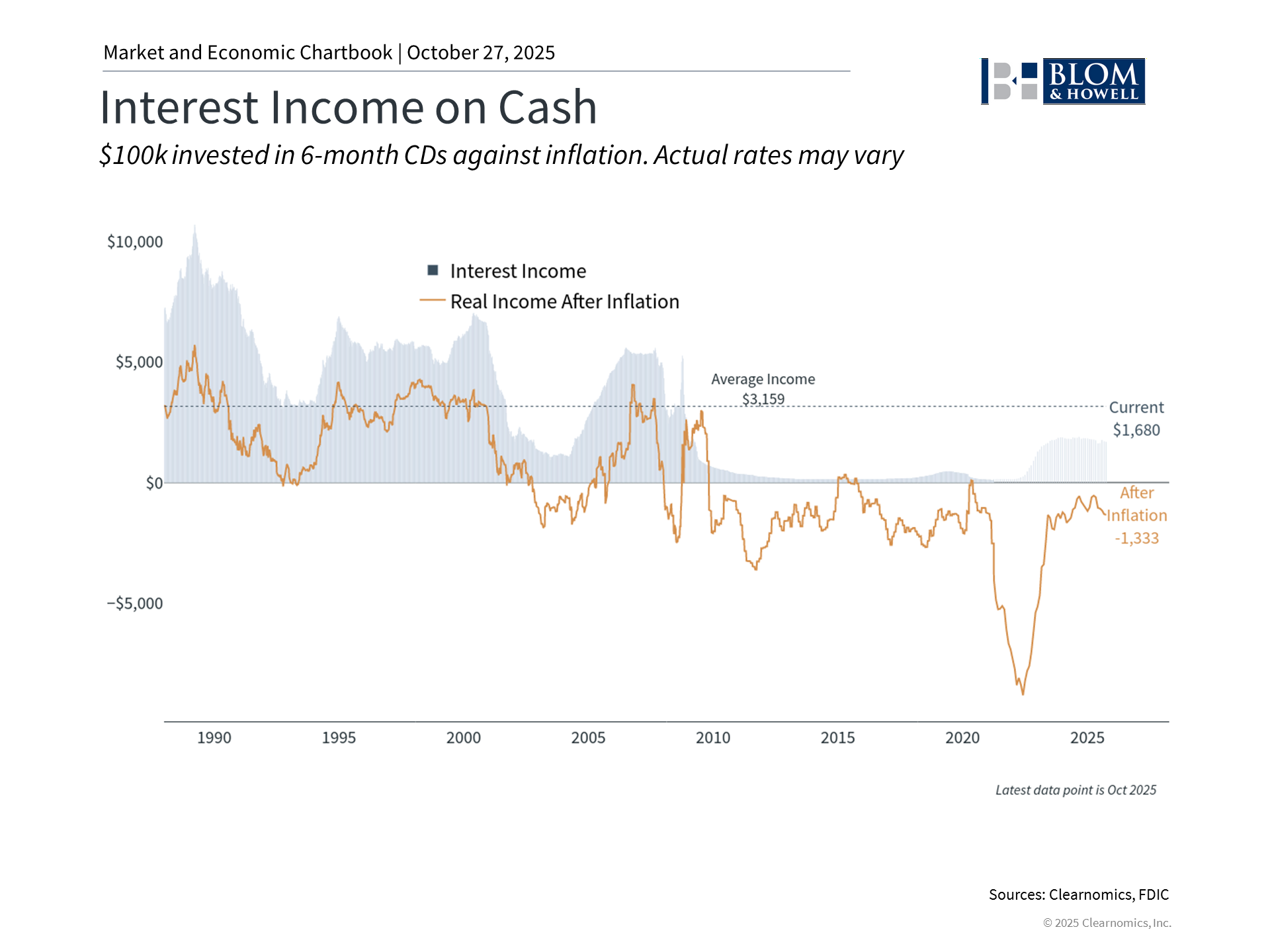

The recent Consumer Price Index data, which had been delayed due to the government shutdown, also has implications for Federal Reserve policy and interest rates more broadly. With inflation moderating and the job market weakening, the Fed is expected to continue gradually lowering policy rates. This shift, while positive for many parts of the economy, will likely reduce the interest income available from cash and money market accounts over time. For retirees who have depended on interest income on their cash holdings over the past few years, this return to a lower interest rate environment may present a challenge. While holding some cash for near-term expenses and emergencies remains important, relying too heavily on cash means missing out on the growth potential of stocks and the attractive yields still available in many bond sectors. The combination of moderating but persistent inflation and declining interest rates creates a challenging environment for conservative investors. Cash loses purchasing power to inflation, and the interest it generates will decline as the Fed continues cutting rates. This makes it even more important for retirees to hold a balanced portfolio that includes growth-oriented assets like stocks, which have historically outpaced inflation over long periods, alongside bonds that can provide income and stability. The bottom line? While Social Security COLA provides some help against inflation, it’s difficult for retirees to rely on this alone. With life expectancies increasing and short-term interest rates declining, investors need portfolios that can provide both income and growth. |

|||

|

Investment advisory services are provided by Blom & Howell Financial Planning, Inc. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

|

Posts you may like

The Role of Social Security in Financial Planning