Monthly Market Update for January: Geopolitics, the Fed, and Precious Metals

|

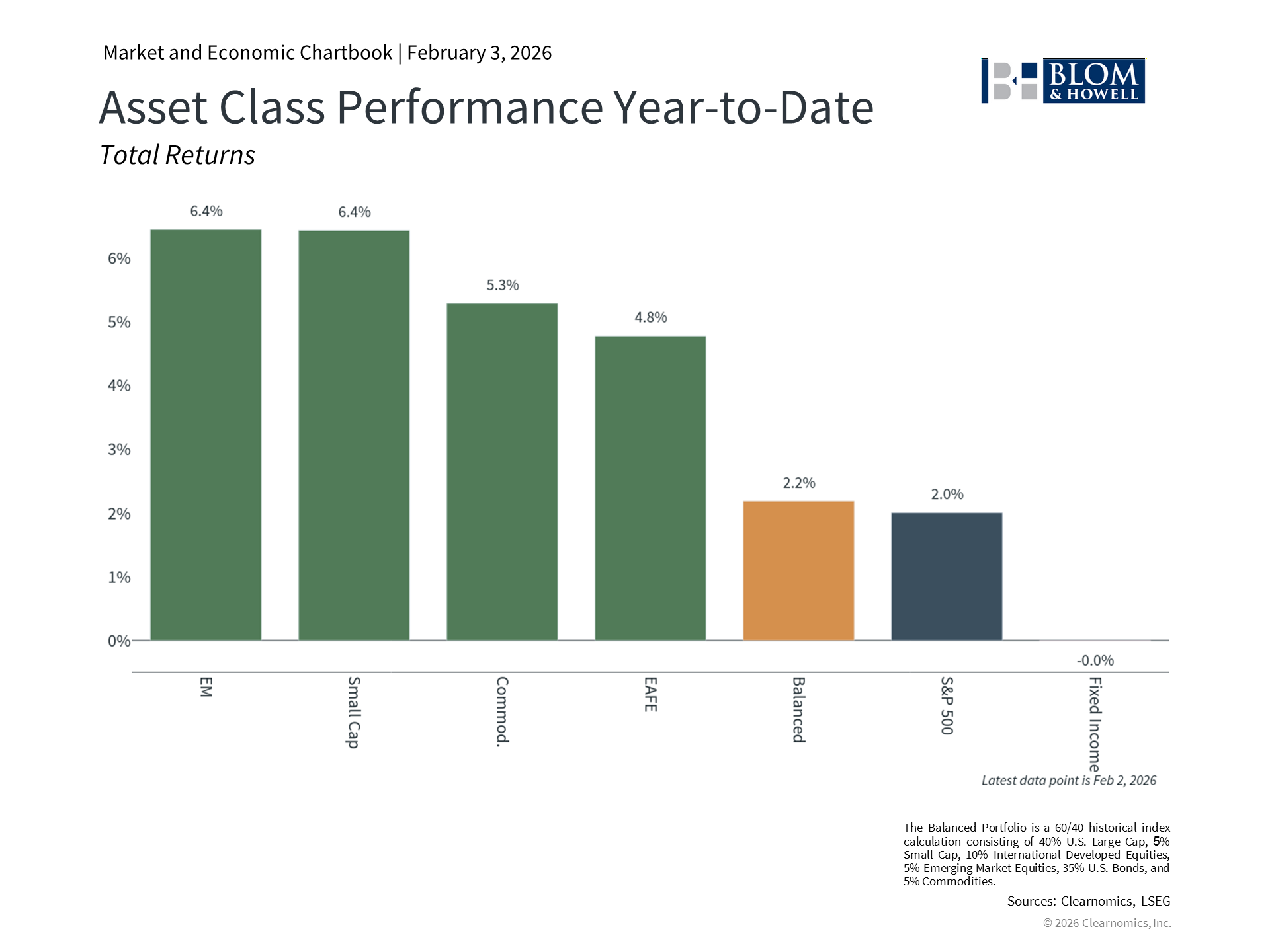

The start of the year was positive for stocks and bonds, continuing the rally from recent years. This might be surprising to some investors since there were several periods of volatility driven by geopolitics and Federal Reserve policy. While headlines created short-term swings, including the S&P 500's worst day since last October, markets rebounded quickly. Within days, major indices reached new all-time highs, driven also by healthy corporate earnings that have supported portfolios. For long-term investors, January serves as a valuable reminder that headlines can move markets in unpredictable ways, but fundamentals and long-term planning are what matter most. While geopolitical events and policy uncertainty will likely create more volatility throughout 2026, the best way to navigate these challenges remains a balanced portfolio aligned with your long-term financial plan. Key Market and Economic Drivers in January • The S&P 500 gained 1.4% in January and briefly crossed 7,000 for the first time on an intra-day basis. The Nasdaq Composite rose 0.9% and the Dow Jones Industrial Average gained 1.7%. • The CBOE VIX volatility index ended the month at 17.44 after rising above 20 due to geopolitical tensions. • The Bloomberg U.S. Aggregate Bond Index climbed 0.1% over the month as long-term interest rates rose. The 10-year Treasury yield ended the month at 4.24%, the highest level since last September. • International developed markets jumped 5.2% in U.S. dollar terms based on the MSCI EAFE Index, while emerging markets gained 8.8% based on the MSCI EM Index. • President Trump announced the nomination of Kevin Warsh as the next Fed Chair. If confirmed by the Senate, he would take office in mid-May. • Gold surged to a record close of $5,417 per ounce before plunging nearly 10% on January 30. • Similarly, silver closed as high as $116.70 before tumbling to finish the month at $85.20. • The U.S. dollar index fell further to about 97.0, reaching its weakest level in nearly four years, before rebounding slightly following the Fed Chair news. • The Federal Reserve held its policy rate at 3.50 to 3.75% at its January meeting, following three consecutive quarter-point cuts in the second half of 2025. • Consumer Price Index inflation remained at 2.7% year-over-year in December, still above the Fed's 2% target. The Producer Price Index accelerated to 3.0%. • Washington ended the month with a partial government shutdown. • Severe winter weather across much of the Eastern and Southern United States caused natural gas and electricity prices to spike. Geopolitical tensions edged market volatility higher

Early in the month, a U.S. operation in Venezuela resulted in the capture of Nicolás Maduro. While the operation centered around narco-terrorism, much of the conversation quickly turned to oil. Venezuela holds the world's largest proven oil reserves but pumps less than 1% of global crude production due to its poor infrastructure. For investors, the primary channel through which geopolitical events affect financial markets is through commodity prices, and oil remains central to the global economy. Geopolitical concerns rose further over U.S. statements regarding the purchase of Greenland due to its strategic importance to defense and commodities. This sparked diplomatic disputes with NATO countries involving tariffs that led to the S&P 500's worst day since last October. However, the situation quickly de-escalated after President Trump met with the NATO secretary general and established a “framework of a future deal,” leading the market to rebound. For long-term investors, geopolitical events may drive short-term uncertainty but history shows that the effects on markets and the economy are often overstated. Markets have typically recovered as the initial shock passes. Investors should avoid over-reacting to headlines and instead maintain a long-term focus on financial goals. Fed concerns affected gold, silver, and the dollar

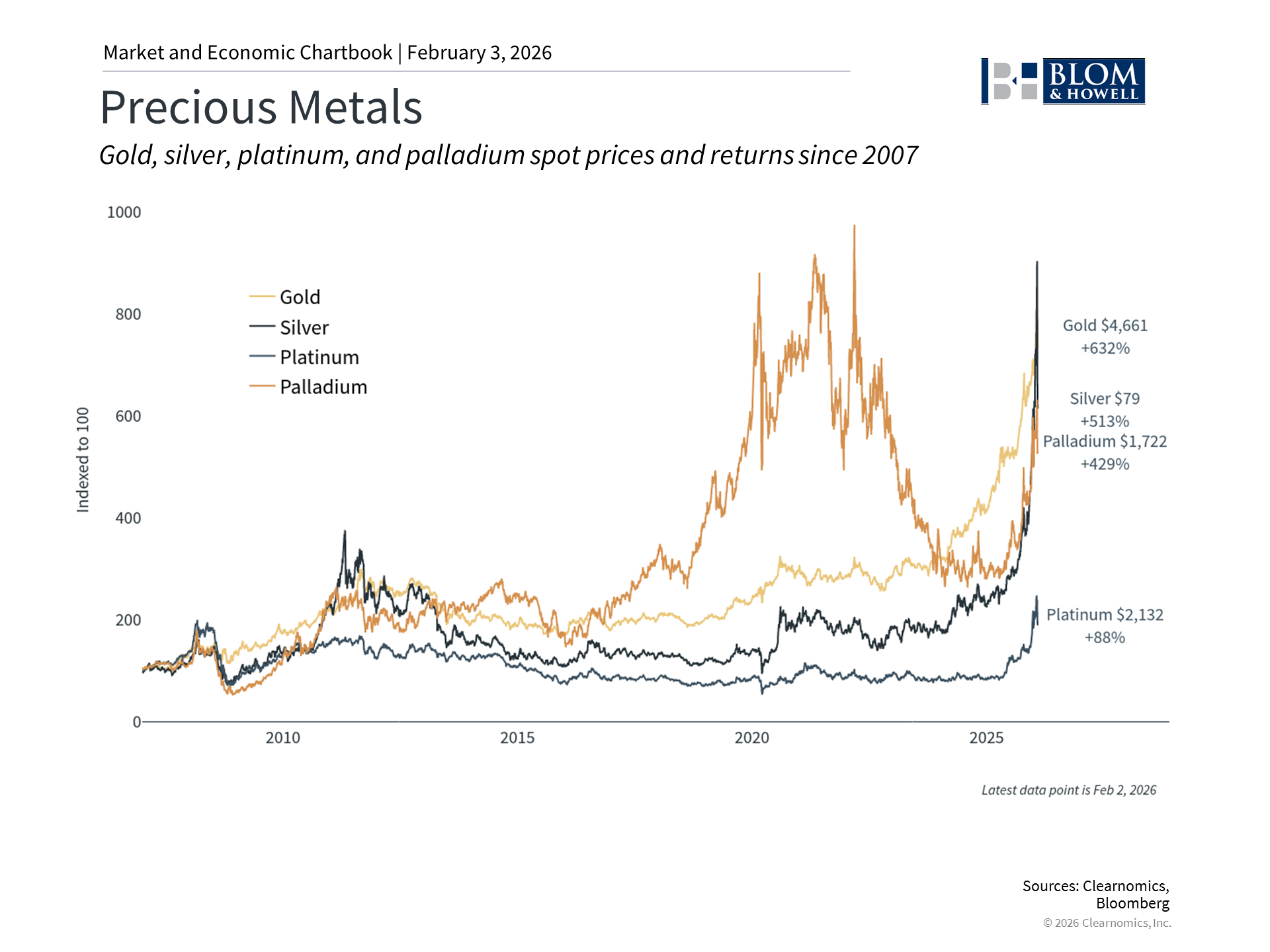

Precious metals continued to rally until a significant reversal on the final day of January. Gold rose to nearly $5,600 on an intra-day basis while silver’s spot price exceeded $120 per ounce before they both sold off. These moves have been driven by a combination of factors including geopolitical risk, central bank purchases, and concerns about Federal Reserve independence. The moves driving gold and silver have been referred to as the “debasement trade,” or the idea that fiscal and monetary policies that effectively weaken the dollar, create deficits, and lead to inflation may strengthen precious metals. Fed uncertainty, including whether a new Fed chair might push interest rates lower, has driven these metals higher. However, on January 30, President Trump announced his intention to nominate Kevin Warsh as the next Fed Chair once Jerome Powell’s term is up in mid-May. Warsh is a former Fed governor who has recently stated that he prefers lower interest rates. However, he has also been hawkish in the past, meaning he has advocated for keeping rates higher to prevent inflation. For investors, this shifted expectations since it suggests there may be a smoother transition between Fed Chairs. This led to a plunge in both gold and silver, with the dollar rising slightly. This reversal underscores both that precious metals are prone to boom-and-bust cycles, and demonstrates how quickly markets can shift based on policy expectations. While precious metals can serve investors, their volatility during January demonstrates why they need to complement, rather than replace, core holdings in stocks and bonds. Corporate earnings remained healthy despite uncertainty

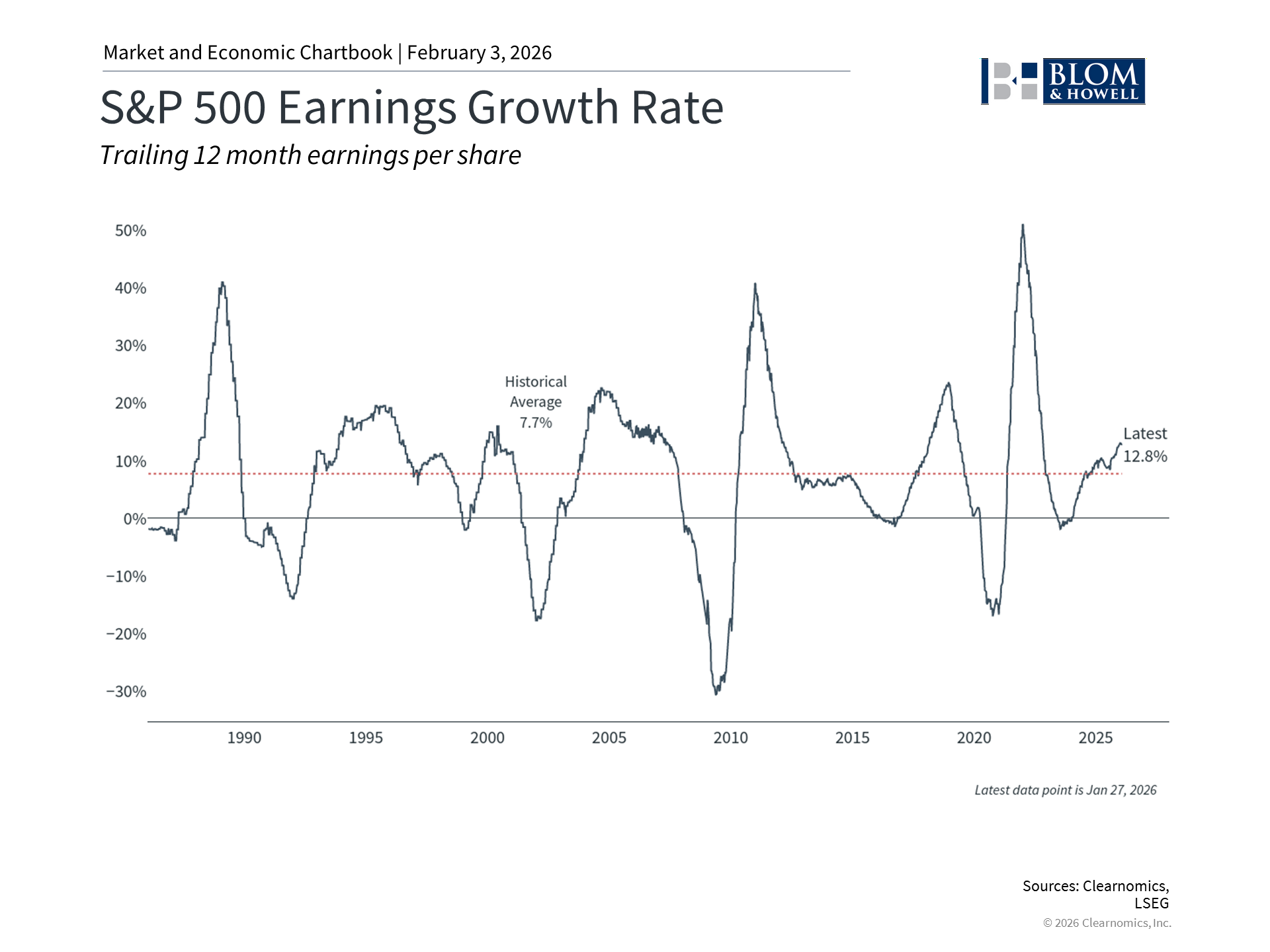

Beyond the main global headlines, the fourth quarter earnings showed that companies continue to perform well. According to FactSet, 33% of S&P 500 companies have reported results and 75% have beaten expectations. If these trends continue, large public companies could be on track to achieve a growth rate of 11.9% for the quarter, representing the 5th consecutive quarter of double-digit earnings growth. On a trailing 12-month basis, earnings growth has accelerated to 12.8% according to consensus estimates. Naturally, many investors are focused on AI and technology earnings since these stocks have contributed to market returns over the past several years. So far, markets have had mixed reactions to the earnings of these companies, even when they beat estimates, due to lofty expectations and questions around the sustainability of this spending. At the same time, many other sectors have benefited from broad economic growth and have grown their earnings at a faster rate as well. For long-term investors, the underlying message from earnings season is positive. Corporate profitability remains strong across many sectors, supporting stock valuations. This fundamental strength is one reason major indices remained positive for the month despite considerable volatility. Severe weather affected much of the country January's severe winter weather, dubbed Winter Storm Fern, affected at least 21 states and more than half the U.S. population. The storm forced state emergency declarations and created disruptions to economic activity, including power outages and thousands of flight cancellations. While the safety of those affected by the storm is the top priority, history shows that weather-related disruptions such as hurricanes and blizzards have little long-term effect on the national economy. The key distinction is whether these events affect productive capacity such as factories, equipment, and businesses, or whether they simply postpone activity. In this case, temporary disruptions to sectors such as retail and construction just shift economic activity forward. The bottom line? January experienced market volatility due to geopolitics, the Fed, and more. However, markets were resilient and healthy corporate earnings have helped major indices reach new all-time highs, even as precious metals stumbled. For long-term investors, this underscores the importance of maintaining a proper asset allocation that is aligned to financial goals. |

|||

|

Investment advisory services are provided by Blom & Howell Financial Planning, Inc. Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

|

Posts you may like

Venezuela, Oil, and the Impact on Portfolios

The Future of the Fed: New Leadership and Rate Cuts