Jobs, Inflation, and Growth: Is the Economy Healthy?

|

The health of the economy is important to long-term investors because it drives their portfolios and their financial plans. Recent economic data points have sent mixed signals, leaving some investors unsure of what to make of the current environment. However, just as a doctor doesn't diagnose a patient based on a single number, investors should avoid drawing conclusions from any one set of data. After all, blood pressure, heart rate, and other measures all tell part of the story, and what counts as healthy can vary from one person to the next. Similarly, payrolls, inflation, and GDP are all vital signs that together provide a full economic assessment. This not only shifts through the course of the business cycle, but different environments can all support portfolios and financial goals. Today's headline numbers are largely healthy: GDP growth is stronger than expected, inflation is slowing, and unemployment remains low by historical standards. However, the labor market tells a more complicated story. While the latest monthly figures were encouraging, hiring over the past year was far weaker than previously believed. For long-term investors, the key is understanding how the data fits together to form a broader perspective, rather than reacting to any single report. The labor market is at an inflection point

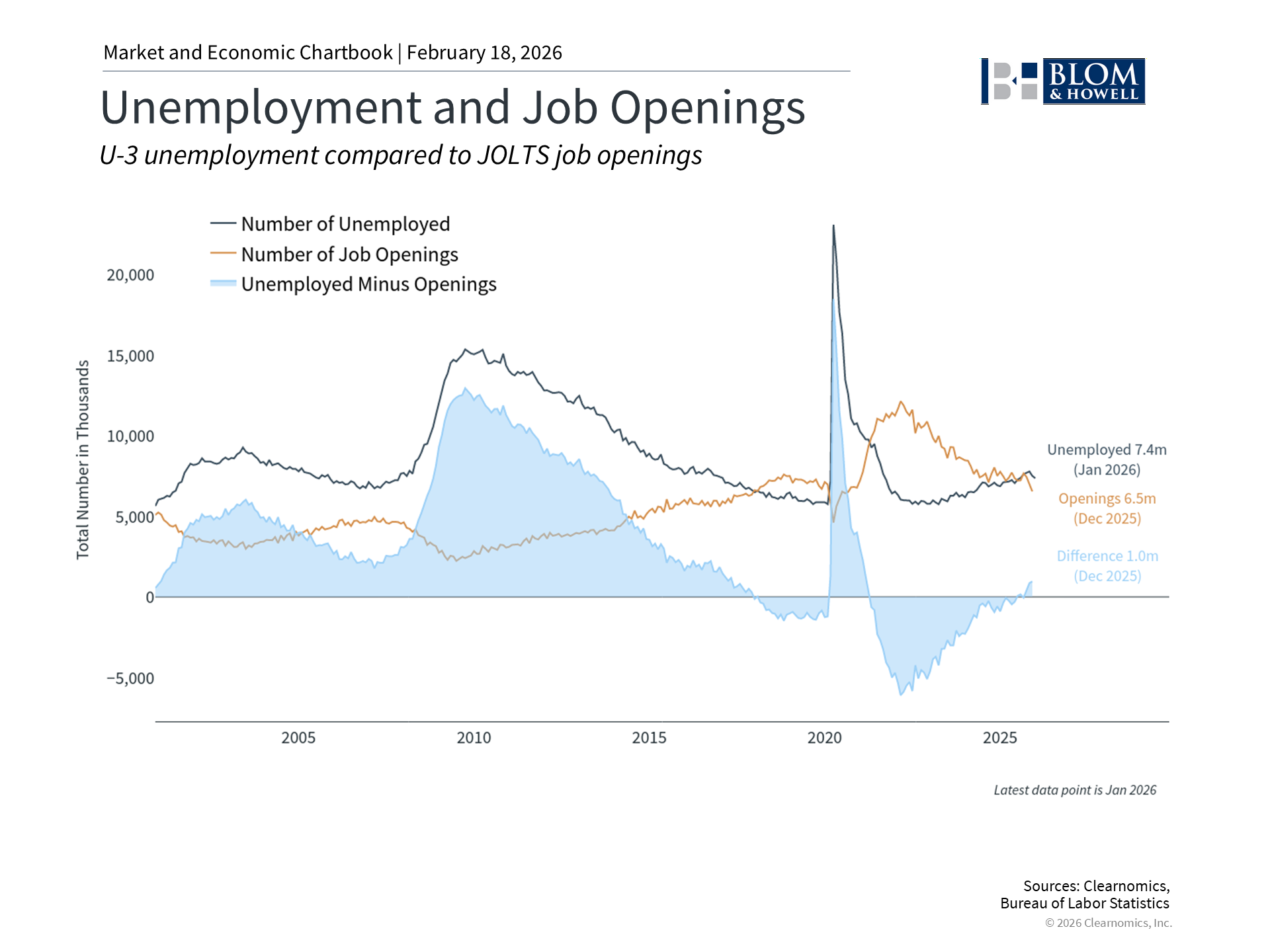

Understanding the labor market has been challenging over the past several months due to government shutdowns that delayed data, bad weather, and other factors. For individuals, perhaps the biggest shift is in the balance between job seekers and job openings. As the accompanying chart above shows, the post-pandemic period experienced several years in which there were more openings than unemployed individuals. This ratio was above one from mid-2021 until last summer, reaching as high as two positions per job seeker in 2022. Today, there are about 7.4 million unemployed Americans but only 6.5 million job openings, the fewest unfilled positions since late 2020. Still, the January jobs report offered good news by showing that the economy added 130,000 jobs that month, nearly double what economists had expected. Many of these jobs were concentrated in the health care, social assistance, and construction sectors. The unemployment rate ticked down to 4.3% from 4.4% and remains near historically low levels. On its own, this could suggest that the labor market is rebounding. While these numbers are positive, the broader trend has been challenging. Specifically, the Bureau of Labor Statistics published their annual revisions which are based on more accurate data than was available at the time of each monthly report. It showed that the number of jobs created over 2025 was only 181,000, or about 15,000 per month, the weakest annual total since 2020. For context, healthy job gains are typically measured in the millions per year, prior to these revisions. Why has the overall unemployment rate stayed relatively low despite slower hiring? Part of the answer lies in demographics and immigration. The Census Bureau recently reported a historic decline in net international migration, which fell from a peak of roughly 2.7 million in 2024 to about 1.3 million in 2025, with further declines expected. Additionally, an aging population and lower labor force participation mean there are simply fewer people entering the workforce. In other words, both the supply and demand sides of the labor market are cooling, which has helped keep the unemployment rate from rising. Jobs, inflation, and the broader economy

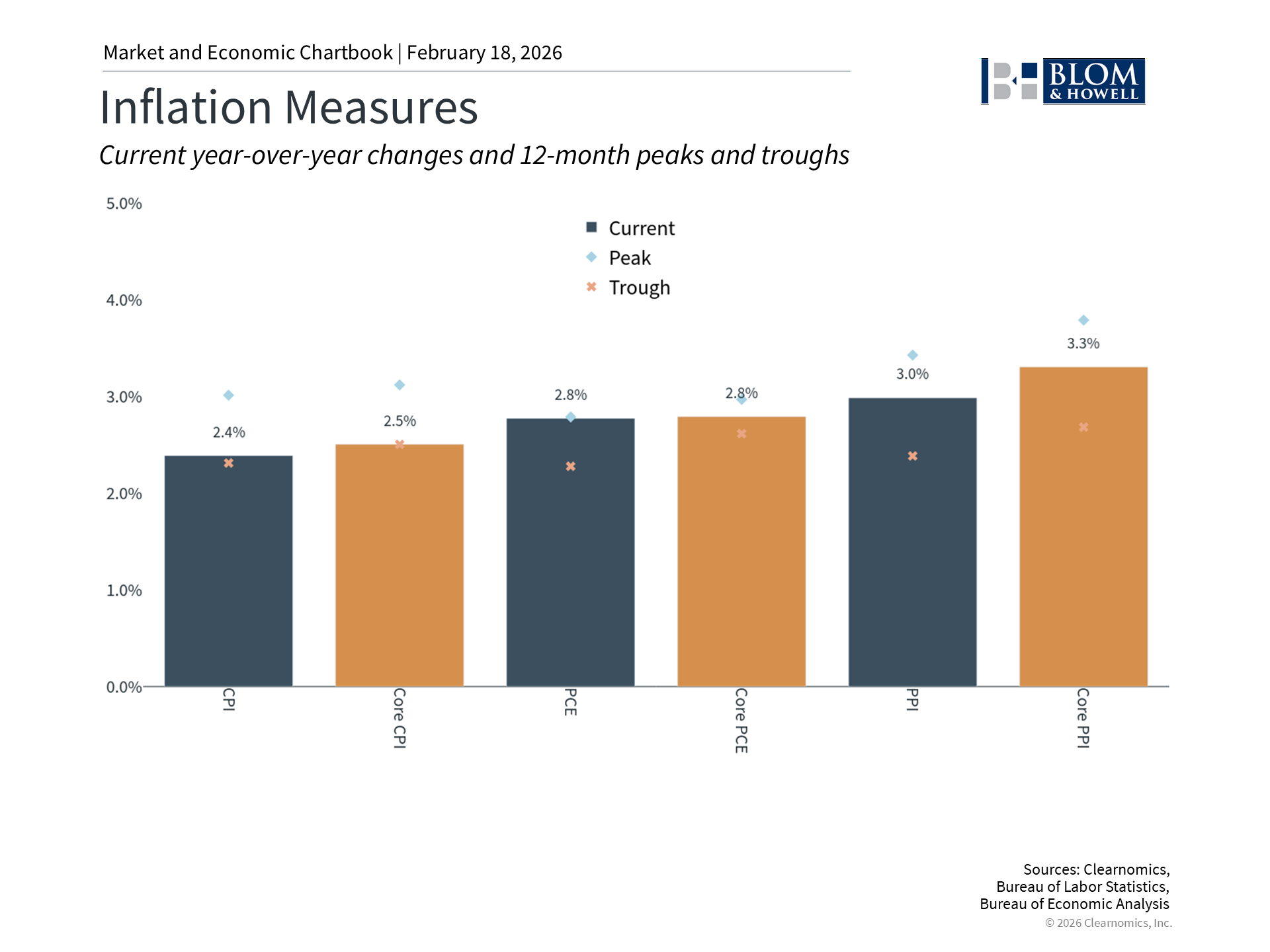

Investors tend to watch the labor market closely because it is tangible in a way that many other economic indicators are not. Specifically, jobs directly affect household income, consumer confidence, and spending decisions. Consumer spending makes up more than two-thirds of the U.S. GDP, so what happens in the labor market eventually flows through to the broader economy. However, jobs are only one part of the equation. Other data, including inflation, provide the perspective that the glass might be half full. This is because, until recently, inflation was the biggest challenge for investors and policymakers alike. The latest data show that the Consumer Price Index rose just 2.4% over the past year, while core inflation, which excludes food and energy prices, decelerated to 2.5%, the lowest level in nearly five years. One measure of “supercore” inflation, which also excludes shelter, rose only 2.1% over the past twelve months. This steady deceleration brings the Fed closer to its 2% target and suggests that the inflationary pressures continue to fade. Of course, high prices remain a challenge for many households and retirees since slower inflation doesn’t mean prices will actually come down. Still, the fact that price pressures have been contained is positive for the economy and for portfolios, since inflation can be problematic for both stocks and bonds. What the economic picture means for portfolios

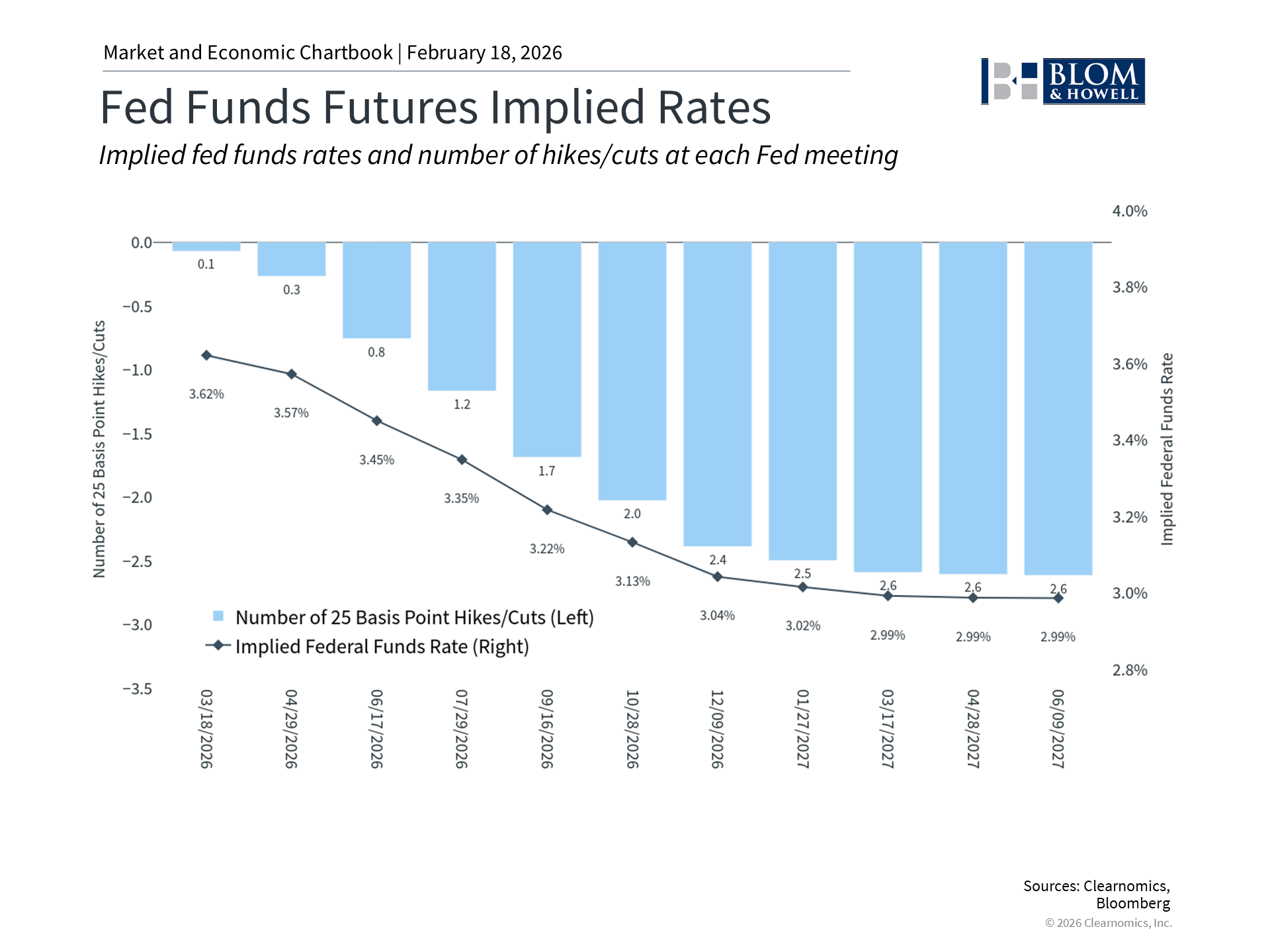

For portfolios, today’s economic environment can be perceived as cautiously positive. The combination of steady growth, cooling inflation, and a softening labor market can create a “Goldilocks” environment that is neither too hot nor too cold. This can benefit both stocks and bonds, especially if it helps to keep interest rates low. The market reaction to the latest employment and inflation data has been a decline in interest rates across the yield curve, with the 10-year Treasury yield just above 4%. These reports also impact Fed expectations and increase the likelihood of policy cuts later this year. At the moment, market-based measures imply at least two rate cuts this year, and the prospect of a new Fed chair, appointed by President Trump, adds to this possibility. Lower rates, if they continue, help portfolios because they reduce borrowing costs for businesses and make future corporate earnings more valuable in today's dollars. Existing bonds also tend to become more valuable when interest rates fall. Even if rates don’t fall further, bonds continue to offer attractive yields and can provide a cushion for long-term investors. Meanwhile, corporate earnings continue to grow, one of the primary factors supporting the broader market over the past year. The bottom line? The labor market is cooling but the broader economy is healthy. For investors, this mixed backdrop supports a balanced approach and reinforces the importance of long-term thinking when it comes to portfolios and financial plans. |

|||

|

Investment advisory services are provided by Blom & Howell Financial Planning, Inc. Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

|

Posts you may like

Monthly Market Update for January: Geopolitics, the Fed, and Precious Metals

Venezuela, Oil, and the Impact on Portfolios