Market All-Time Highs Amid a Noisy Period

|

The S&P 500 notched ten new all-time highs in July, fueled by strong corporate earnings, resilient economic data, and new trade deals ahead of the tariff deadline. This included six consecutive record closes in the second half of the month, all of which contributed to year-to-date gains of 7.8% for the S&P 500. However, market and economic uncertainty resurfaced at the end of the month. The July 31 announcement of new tariff rates has raised concerns over rising prices for consumers. Additionally, the July jobs report revealed that the labor market has been much weaker over the past three months than previously believed. In this environment, it’s important for investors to stay even-keeled as markets adjust to new trade announcements and economic data. The last several months are a reminder that a lot can change in just a few weeks, so maintaining a long-term perspective is still the best way to achieve financial goals. Key Market and Economic Drivers

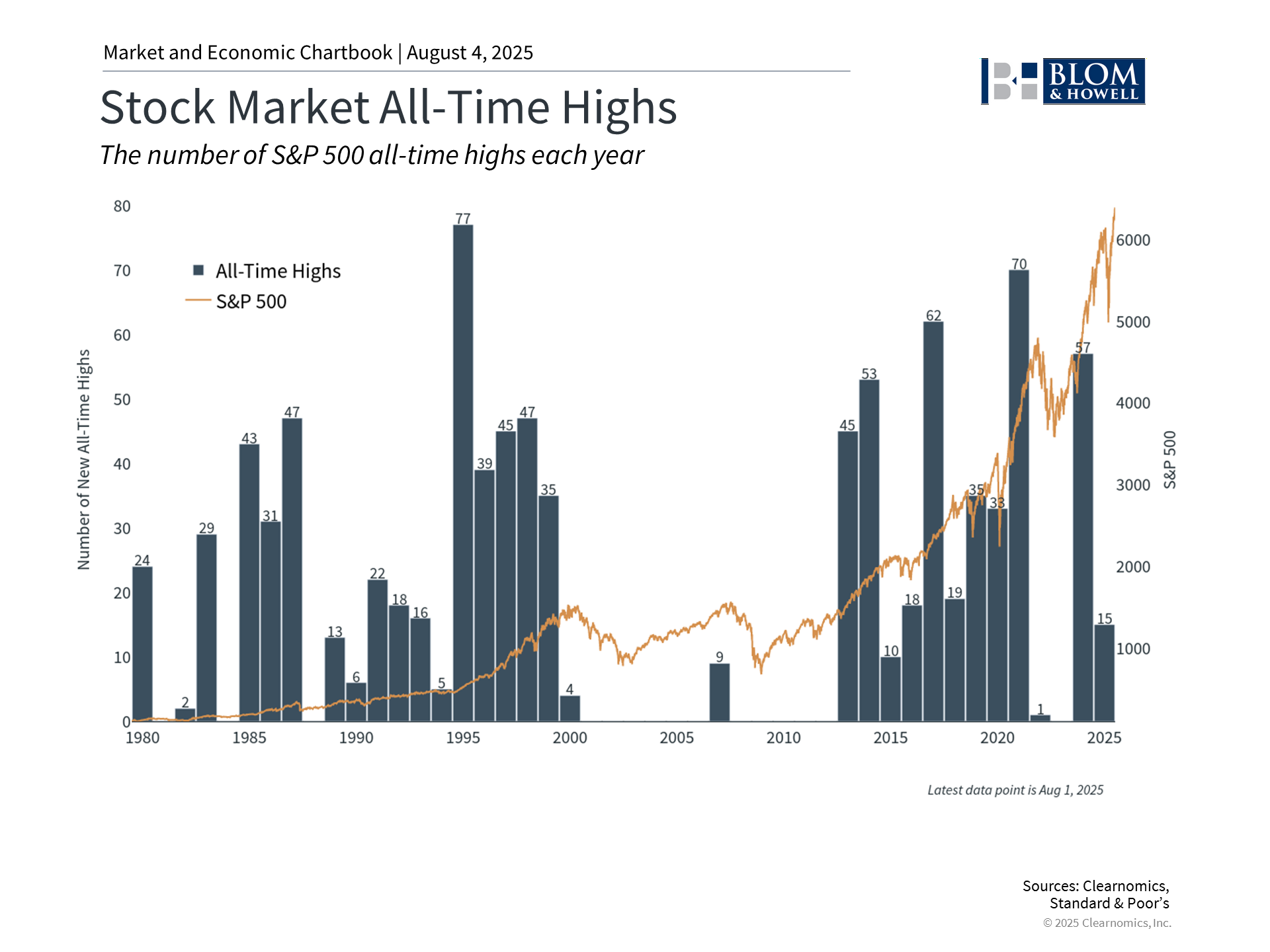

Markets reached new all-time highs

The second quarter earnings season that kicked off in July continues to show positive surprises, driving markets higher. While many companies have reported some impact from tariffs, the effects have not been consistently negative. With over a third of S&P 500 companies reporting, 80% had positive earnings-per-share surprises. The blended earnings growth rate is now 6.4% per year, which is lower than in recent quarters but above what Wall Street analysts had expected.1 Enthusiasm for artificial intelligence supported several Magnificent 7 stocks. Both Microsoft and Meta reported better-than-expected earnings amid major investments in AI infrastructure. In response, Microsoft joined NVIDIA as the second company in history with a market capitalization of over $4 trillion. Meanwhile, Tesla reported disappointing results for the second quarter, dragging its stock price down. While tech stocks have had an uneven ride so far in 2025, the Information Technology sector is up over 13% on the year, second only to Industrials which has returned over 15% so far in 2025. Meanwhile, Health Care and Consumer Discretionary stocks have lagged and are in the red. In fixed income, it was a relatively muted month, with bonds falling slightly in aggregate. The Fed held rates steady within a range of 4.25% to 4.50% for the fifth meeting in a row as it balanced inflation concerns due to tariffs with economic growth. However, for the first time since 1993, two Fed governors voted against the action, preferring a quarter point cut. This follows ongoing public tension between President Trump and Fed Chair Powell as the White House continues to urge the Fed to lower interest rates. New data after the meeting showed that hiring weakened in July, with 73,000 jobs added during the month. Previous reports were revised downward, meaning there were 258,000 fewer jobs added in May and June than originally reported. The three-month average is now only 35,000 new jobs per month, far below the historic average. This suggests that the Fed may have to shift some of its focus to the employment side of its mandate, increasing the possibility of rate cuts, possibly beginning in September. Investors await new trade deal and tariff announcement

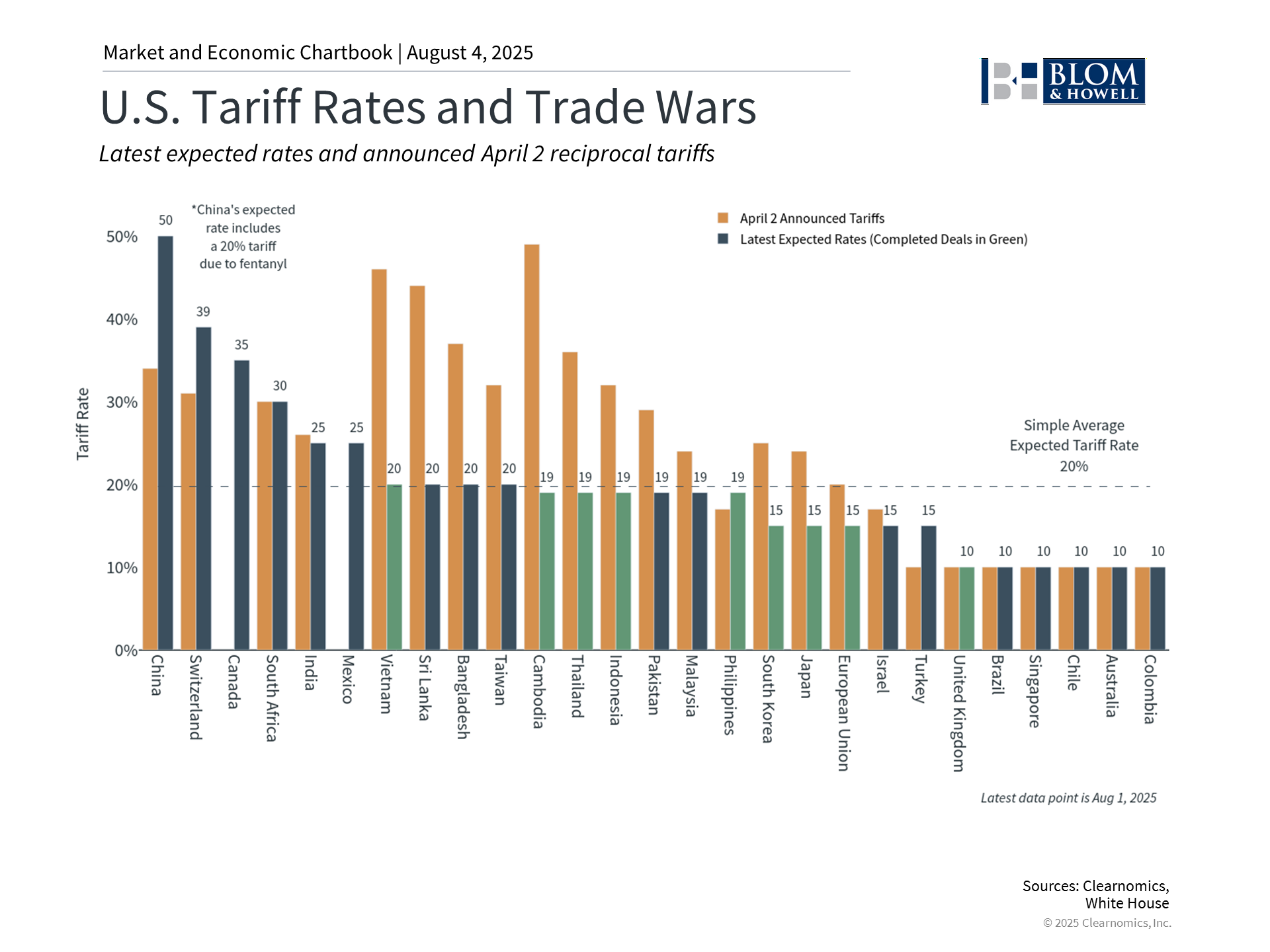

The White House announced several new trade deals throughout July, including with the European Union, Japan, and South Korea. Trade negotiations with China are ongoing. These deals avoid the worst-case scenario that many investors feared in April, but many other countries are still facing potentially higher rates as the deadline to negotiate expires. On July 31, President Trump issued an executive order with new tariff rates for many trading partners set to go into effect on August 7 (the previous tariff deadline was August 1), as shown in the chart above. As of July 23, the Yale Budget Lab estimates that consumers face an overall effective tariff rate of 20.2%, the highest since 1911. So far, it appears that companies have managed to absorb much of this extra cost rather than pass it on to consumers. Whether this remains the case depends on where tariffs ultimately land and how companies manage to adapt. The government passed major legislation on tax and cryptocurrencies

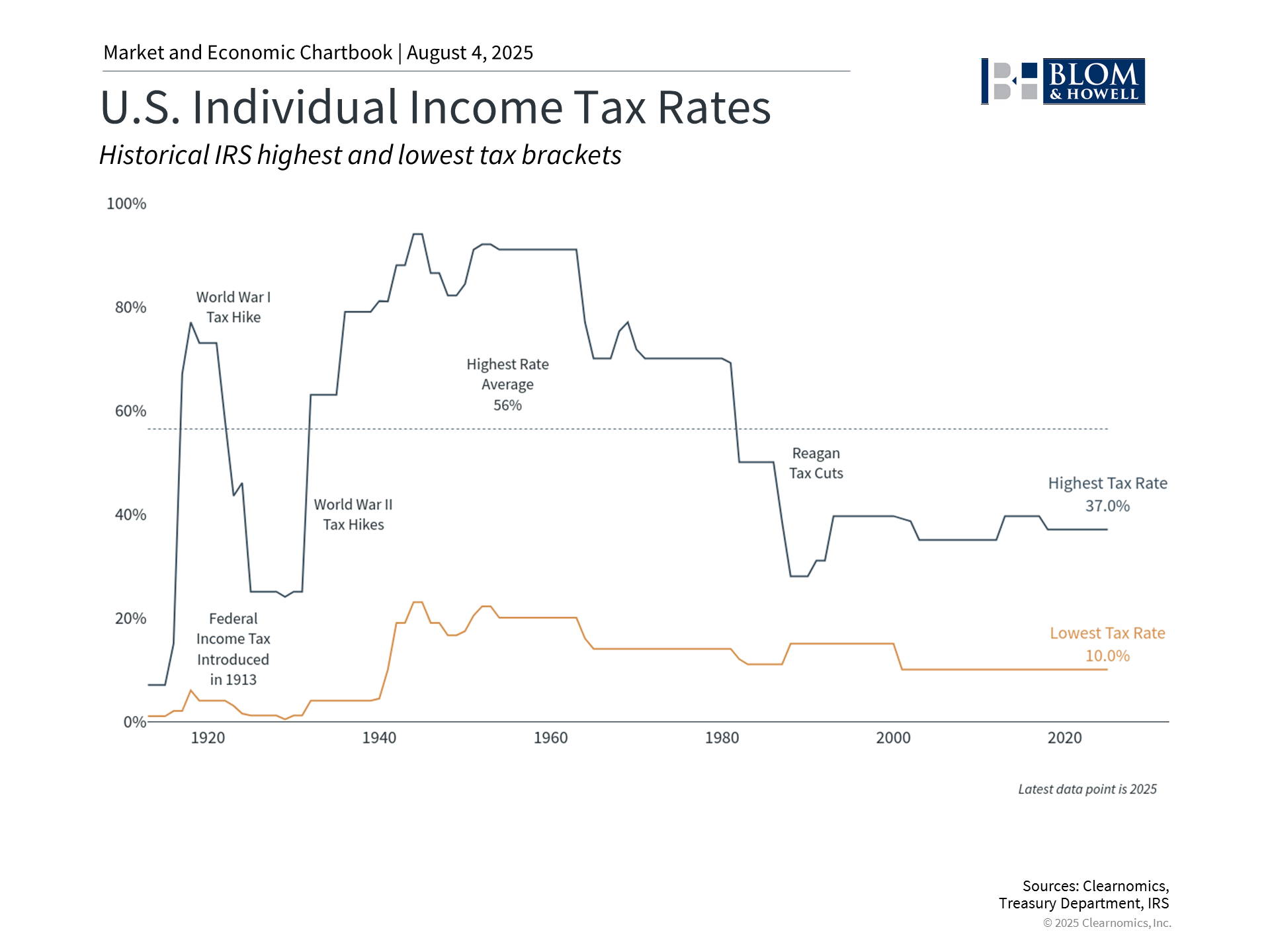

Bitcoin reached new highs in July as Congress considered new legislation to regulate cryptocurrencies. The perceived friendliness of the administration toward wider adoption of cryptocurrencies has resulted in gains for Bitcoin in 2025. Separately, the GENIUS Act, which has been signed into law, focuses on stablecoins which are often pegged to the U.S. dollar. On July 4, President Trump signed a comprehensive tax and spending bill that made many provisions from the Tax Cuts and Jobs Act permanent, including current tax rates and brackets. The bill provides more certainty to investors by maintaining the current low-tax environment, but also raises concerns about the sustainability of the growing national debt. The Congressional Budget Office estimates the bill will add over $3 trillion to the national debt over the next decade. While there were spending cuts to major programs in the bill, they were more than offset by reductions to tax revenue. The permanent nature of many of these tax changes removes uncertainty that has affected long-term financial planning, since many provisions from the TCJA were scheduled to expire this year. This could help support business investment and consumer spending in the near term. The bottom line? The market reached many new highs amid a noisy month of tariff whiplash, a new tax bill, and earnings. As we head into August, trade deals and earnings will likely remain a focus for investors. 1.https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_072525.pdf |

|||

|

Investment advisory services are provided by Blom & Howell Financial Planning, Inc. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

|

Posts you may like

Jobs, Inflation, and Growth: Is the Economy Healthy?

Monthly Market Update for January: Geopolitics, the Fed, and Precious Metals